What are the Benefits of a Series LLC?

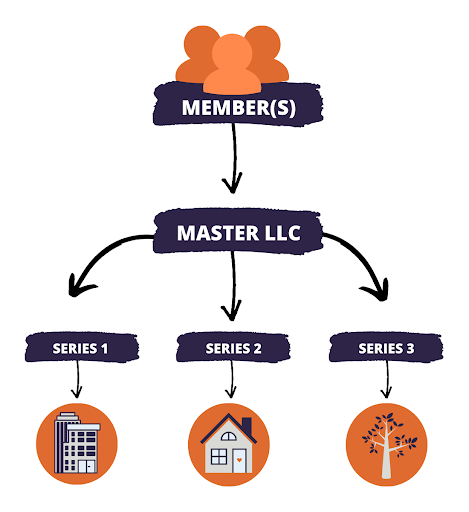

First, and maybe the most important benefit is that a Series LLC provides protection for each child series and its assets from the liabilities of the other child series and the master LLC.

For developers, normally each project created mandates new LLC for that project. Looking into this type of business structure can be a good idea because it will allow the company to have one main master company and each project would be the child series.

This is also a benefit for real estate investors. This gives them the ability to separate and protect their individual properties. Investors can put their investments into different series based on each investment's possible risk.

Another benefit is that each child series does not need to file taxes, as the master LLC series files on behalf of them. This gives you a huge reduction in paperwork that is needed annually and substantially cuts costs compared to having multiple traditional LLCs.

Each series is also able to enter contracts, hold and sell assets, grant liens, and sue.

There are several other benefits to a Series LLC. It is best to contact a CPA or Tax Professional for advice on which structure is best for your business.